Here’s (Google) Translated from Mandarin statement of People’s Bank of China ICO Ban for anyone interested out there – I guess this is main highlight on the markets today. I’ve marked most important in parts in bold:

“Recently, the domestic through the issuance of tokens, including the first tokens (ICO) financing activities in large numbers, speculation prevails, suspected of engaging in illegal financial activities, seriously disrupted the economic and financial order. In accordance with the Law of the People’s Bank of China, the Commercial Bank Law of the People’s Republic of China, the Securities Law of the People’s Republic of China, the People’s Republic of China, The Republic of China Network Security Law, the People’s Republic of China Telecommunications Ordinance, “illegal financial institutions and illegal financial business activities,” and other laws and regulations, the relevant matters are as follows:

First, an accurate understanding of the essential properties of the custody financing activities

Toll coin financing refers to the financing of the main body through the token of illegal sale, circulation, to investors to raise Bitcoin, currency and other so-called “virtual currency” is essentially a non-approved illegal open financing behavior, suspected of illegal sale Tokens, illegal securities issuance and illegal fund-raising, financial fraud, pyramid schemes and other criminal activities. The relevant departments will closely monitor the dynamics, strengthen cooperation with the judicial departments and local governments, in accordance with the existing working mechanism, strict law enforcement, resolutely control the market chaos. Found suspected criminal problems, will be transferred to the judiciary.

The tokens or “virtual currency” used in coinage financing are not issued by the monetary authorities, do not have legal and monetary properties such as indemnity and coercion, do not have legal status equivalent to money, and can not and should not be circulated as a currency in the market use.

2. No organization or individual may engage in unauthorized custody financing activities

As of the date of this announcement, all types of currency issuance financing activities shall cease immediately. The organizations and individuals who have completed the financing of the tokens should make arrangements for repatriation and so on, reasonably protect the interests of investors and properly handle the risks. The relevant departments will seriously investigate and deal with non-stop tokens issued financing activities and the completion of the tokens issued financing projects in the illegal acts.

Third, strengthen the management of tokens financing trading platform

As at the date of this announcement, any so-called tokens financing trading platform shall not engage in the exchange of legal currency and tokens, “virtual currency”, and may not be traded or sold as a central counterparty to sell tokens or “virtual currency” Not for the tokens or “virtual currency” to provide pricing, information services and other services.

For the existence of illegal problems on behalf of the coin-financing trading platform, the financial management department will be submitted to the telecommunications authorities in accordance with the law to close their website platform and mobile APP, to the network letter to the mobile APP in the application store to do the next frame disposal, and to the business administration Revoke its business license.

4. Financial institutions and non-bank payment institutions shall not carry out business related to tokens financing transactions

Financial institutions and non-bank payment agencies may not directly or indirectly provide financing and “virtual currency” to provide account opening, registration, trading, liquidation, settlement and other products or services, shall not be covered and tokens and “virtual currency” Of the insurance business or the tokens and “virtual currency” into the scope of insurance liability. Financial institutions and non-bank payment agencies found that the currency issuance of financing transactions illegal clues should be promptly reported to the relevant departments.

Fifth, the public should be highly alert to the risk of currency issuance financing and trading risks

There are multiple risks in the issuance of coins and transactions, including false asset risk, risk of business failure, and risk of investment speculation. Investors are required to bear the risk of investment. We hope that the majority of investors will be not deceived.

The use of the “currency” of the various types of illegal financial activities, the public should strengthen the risk prevention awareness and recognition ability, timely reporting of relevant illegal clues.

Sixth, give full play to the role of industry organizations self-discipline

All kinds of financial industry organizations should do a good job of policy interpretation, and urge the member units to consciously resist the illegal financing activities related to the currency issuance financing transactions and the “virtual currency”, away from the market chaos, strengthen investor education and jointly maintain the normal financial order.”

So to summarize:

- All trading platforms in China are prohibited from doing conversions of coins with fiat currencies (like USD),

- All money raised by ICOs must be refunded to buyers,

- Digital tokens can’t be used as currency on the market and banks are forbidden from offering services to ICOs,

- Other markets may follow – US also wants to clampdown on ICOs.

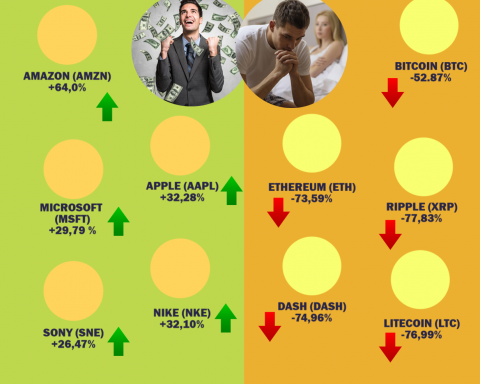

This hits Etherum so much, because many ICOs shares were exchanged for this cryptocurrency, and Chinese miners mine 99% of virtual currency (though no one knows exactly how much). In long term this hurts especially smaller cryptos, so don’t buy “the dip”. Despite many people claiming that its “very good for cryptos, because it will clean out market from ‘Chinese scammers'”, final results will be most likely long term losses in value of cryptos.