Lithium is a strategically important element, essential for making batteries for smartphones, laptops, electric cars. Almost entire consumer electronics containing power cells are using Li-Ion batteries. In the last 12 months, lithium futures already prices went up 300% – and they’re poised to increase thousands of percent more, as growing electric cars production will increase demand at least twenty times

What are the main uses of lithium?

This the softest metal that can be cut easily with a kitchen knife and it’s the lightest solid element in the periodic table. It is considered a rare metal, as its deposits are not as numerous as aluminum. Some of its most important applications cover:

Batteries: Li-Ion batteries, developed in 1985 by 2019 Nobel Prize laureate Akira Yoshino power smartphones, laptops, electric cars, and other consumer electronics. The surge in electric cars productions was the main reason behind the growing prices of lithium, which could become scarce soon.

Li-Ion batteries range from tiny CR-2032 type “button” batteries used in small consumer electronics to big batteries in electric cars

Arms production: Lithium is necessary for rocket propellants and can be used as a solid fuel.

US Navy’s Mk 50 torpedo uses Lithium as a propellent

Medicine: Lithium salts are used in the treatment of bipolar disorder and schizophrenia by increasing serotonin synthesis. It’s a generic and effective drug manufactured under many brands.

Nuclear fusion: Used in tritium production and in nuclear fusion.

Afghanistan’s lithium deposits

As it happens, Afghanistan has very likely world’s largest lithium reserves in a form of lithium carbonate deposits.

As Pentagon said more than ten years ago the country could become the “Saudi Arabia of lithium”. US officials said that Afghanistan is sitting on mineral resources worth $1 trillion and could become one of the world’s most important mining centers.

The only thing, that is preventing the Taliban from taking advantage of these huge resources is, for now, the lack of infrastructure and specialists to mine it. Jack Medlin, a geologist in the United States Geological Survey’s international affairs program puts it:

„This is a country that has no mining culture. They’ve had some small artisanal mines, but now there could be some very, very large mines that will require more than just a gold pan.”

However, this can change very fast. Chinese are eager to take advantage and revel in the free world’s Coalition defeat.

Two people fell off the plane to their deaths in #Kabulairport, when U.S. troops and military dogs were evacuated from #Afghanistan with reserved seats on flights #KabulMoment pic.twitter.com/IeYyJP2pit

— China Xinhua News (@XHNews) August 18, 2021

Chinese State News agency Xinhua taunting the United States on Twitter.

Chinese Foreign Minister Wang Yi and Mullah Abdul Ghani Baradar, one of the Taliban founders met just three weeks ago in Tianjin, China, already talking about the post-war cooperation. China is offering economic support and investment for the Taliban-controlled Afghanistan. That the Chinese are godless communists doesn’t seem to be bothering Islam’s holy warriors.

With Chinese expertise and money, rare elements can be exploited easily, as China is hungry for mineral deposits, trying to find a way to soften the impact of rising prices of commodities on their production capabilities. Chinese are sharing 47-mile border with Afghanistan and can enter the country very quickly. Both Taliban and Chinese are interested in the cooperation – or more precisely, enormous amounts of money to be made from this soft metal.

Lithium investing – viable?

Oh yes. There are plenty of companies and even recently created ETFs to invest in this market. Investing in lithium futures directly might be a bit difficult, as not many brokers allow us to trade it, but fortunately, we have a stock market.

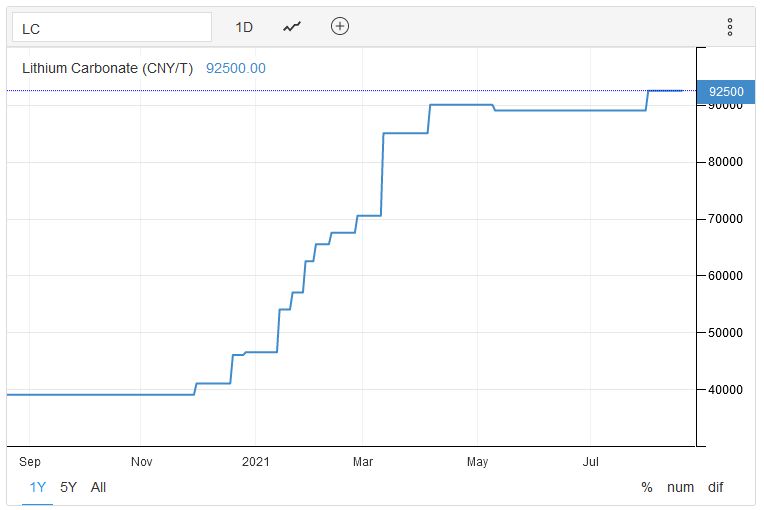

Forget the blue chips, Lithium Carbonate prices went up 300% in 12 months – and they’re still far from ATH.

My favorites are:

LIT – Global X Lithium & Battery Tech ETF

130% up last 12 months. Most of its holding are Chinese stocks (50%+), which makes it a great investment opportunity, considering companies like Ganfeng Lithium Co. Ltd. might enter Afghanistan soon. Listed on NYSE Arca.

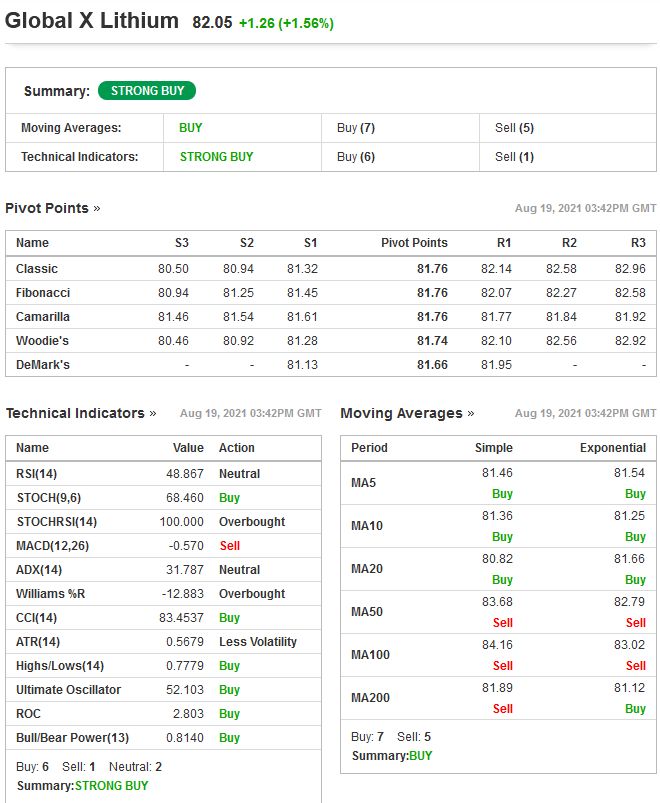

Technical indicators are very bullish on hourly chart

LAC – Lithium America Corp.

Canadian company with mines in North and South America. +106% last 12 months. One of the biggest lithium mining companies, expanding very fast, with upcoming new projects.

American and European policies of cutting down CO2 output by reducing the number of combustion engine cars and are fostering high lithium prices as electric cars batteries are big and will require replacement every few years. This might indeed make Aghanistan “Saudi Arabia of lithium”, making new Taliban sheiks rich in “lithium dollars” as opposed to “petrodollars”. Either way, investing in lithium will continue bringing more profits from increasing demand, so be sure to take the opportunity, and have a big gains!