Internet investors fell terribly to the social media-originated meme of getting rich by buying GameStop stocks and becoming „an ape”. Unfortunately, GME stock lost 50% value since its Internet-fueled rally 6 months ago as the price tanked from $325 to $170 per stock. This equals to huge loss of more than $10 billion that already evaporated from the market. GameStop debacle is a sad story of how easy is to fall prey to own greed by staying too long in the Internet echo chamber of deluded opinions.

GameStop: When Common Sense Stopped

It all started when anonymous users centered around social media portal Reddit communities like r/GME and r/superstonk (the latter subreddit splintered from r/wallstreetbets after the big drama, when cult-like posts were stopped being accepted there) started posting images with captions suggesting that GameStop is a “meme stock”, and that it should rise on the power of individual social media investors.

As with many memes, the boom spawned by Internet popularity was sudden, but short-lived. GME buyers lost about $11 billion in the last months since the stock dipped down by more than 50% from $325 to $170.

It’s important to mention that this rally wasn’t fuelled by any fundamental factor. GameStop’s business model is an obsolete one and it’s based mostly on selling video games in brick-and-mortar stores.

In fact, GameStop is shrinking each year, closing 693 stores in 2020 and withdrawing altogether from markets like Nordic countries. Unsurprisingly, the company is also completely unprofitable since 2018.

GME store looted during last year’s racial riots in Chicago.

And yet, Reddit users centered around Reddit communities like r/superstonk and r/GME (totally more than a half-million users) refuse to admit that buying GME stocks was a very bad idea. Instead, they found the imaginary culprit, who is guilty of manipulating the price.

The Protocols of the Elders of Hedge Fund

To defend bad decision-making, Reddit communities produced thousands of posts daily that contain lots of delusions, lunacy, and outright lies – and some of them were clearly written by mentally unstable people. They found the enemy that is suppressing GameStop stock value – the hedge funds.

Reddit users are personally harassing various hedge funds managers. They especially target Citadel’s Kenneth Griffin, by posting daily tens of disparaging and derogatory memes about him, which clearly show some kind of unhealthy obsession. Reddit is usually mindful when it comes to harassing people online, just not when it’s about the money.

It doesn’t end at the unfunny memes. That’s because the Great minds of Reddit discovered the great stock market conspiracy and worldwide media are silent about it. Some of the hot takes include:

It’s obviously the CIA that wants to suppress the failing video game company basement movement.

Even Hitler pops up in the GameStop discussions. You can’t have a good thread without a Hitler.

You should listen only to the football news and murders news. I know where to watch football news, but I’m not sure where can I exactly watch my daily dose of murder news?

Also in the same thread. Corrupted media not only suppress the truth about GameStop but also about ALIENS!

4chan business /biz board is also highly optimistic regarding price levels, in the usual fashion. Unfortunately, this kind of vile posturing is quite typical for the cult.

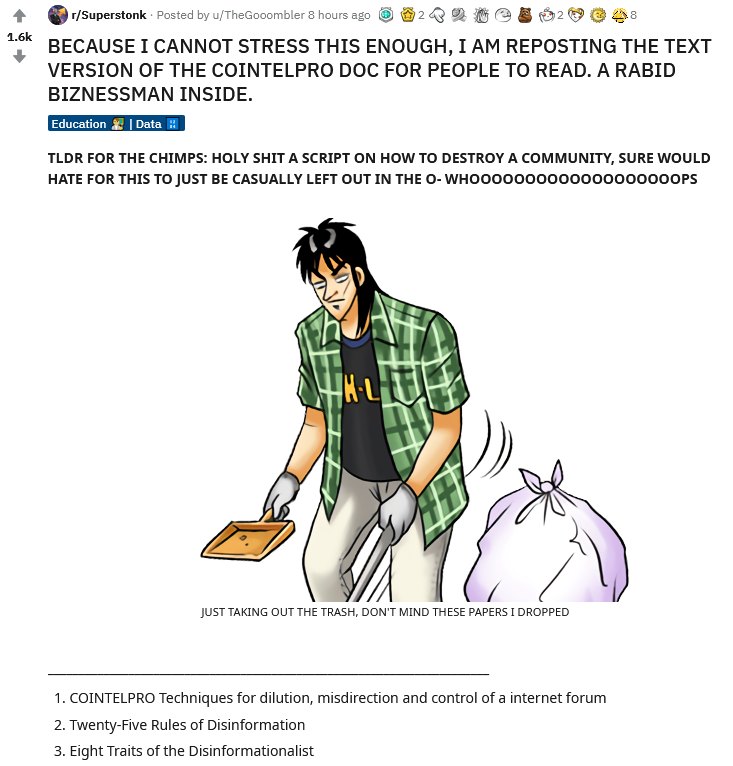

And the icing on the cake is a “real CIA document on how to destroy internet community” posted by an anonymous hacker (known as 4chan) on GameStop subreddit:

Totally sane and rational discussion ensues. Unfortunately, this hoax is disturbingly similar to the much darker text of The Protocols of the Elders of Zion. Daniel Pipes (son of better known Richard Pipes, who dealt with the history of economy, among many disciplines) explains why the text is so alluring and became popular:

“The book’s vagueness—almost no names, dates, or issues are specified—has been one key to this wide-ranging success. The purportedly Jewish authorship also helps to make the book more convincing. Its embrace of contradiction—that to advance, Jews use all tools available, including capitalism and communism, philo-Semitism and antisemitism, democracy and tyranny—made it possible for The Protocols to reach out to all: rich and poor, Right and Left, Christian and Muslim.”

Just replace Jews with Hedge Funds and you will get the full treatment of GameStop Reddit community insanity.

Sadly, the post with “secret COINTELPRO CIA documents” is one of the most popular posts in this community, garnering thousands of likes and dozens of Reddit Awards. The latter are virtual medals you can buy for real money, to award the poster. They should rather be spending this money on a therapist, to get some mental treatment instead.

Balance sheet

But what it if they’re right? The media are silent about the big conspiracy and GameStop is in fact the messiah of the stock market, crucified by Kenneth Rogers? It’s easy to rebuke all this nonsense by looking at the GME quarterly reports and income statements. And – boy, have I got some bad news for you.

Gamestop finance sheet from Yahoo Finance

Operating income: -237 million

EBITDA: -155 million

Store sales decrease YoY: 9.5%

A number of stores closed in 2020: 693. Covid-19 hit them hard and only accelerated the outflux of customers to online platforms.

GameStop is an unprofitable company that burns investors’ money. Its business is obsolete as everyone is buying games on Steam, GOG or Epic Game Store or Amazon, or thousands of other online game stores. Why would you go to a brick-and-mortar store to buy video games? It’s not 2005 anymore. This question is reflected by constant loss on GameStop income statement, with the last profitable year being 2018. GameStop is getting worse each year, as it’s badly managed and won’t get better unless they completely turn their sales somehow. But it won’t happen, because GameStop has no plan what to do in 2021 to stop the decline. The strategy presented in the last GameStop quarterly report (Q4 2020) contains a lot of empty buzzwords that mean nothing, like:

- “Investing in technology capabilities”,

- “Expanding product offerings”,

- And of course “Building a superior customer experience”.

What would say these eager future GME billionaires doing their “due diligence”? I guess they never heard of balance sheets.

Very low trading volume contradicts manipulation fantasies. No one cares, even the mysterious hedge fund bogeyman, as the trading volume fell to as low as several million USD per day and it’s constantly waning, as you can see on the lower portion of the chart:

GME trading volume is indicated by green and red bars at the bottom. You can see it’s at a fraction of what it has been half year ago, which means the rally was fueled by social media frenzy and not institutions.

All these made-up stories about buzzwords like “ladder attacks”, “naked shorting”, “wash selling”, “dark pools” are pure drivel. This stupidity isn’t confirmed in the stock market data.

Great minds of Reddit discovering a great conspiracy procured to made them poor.

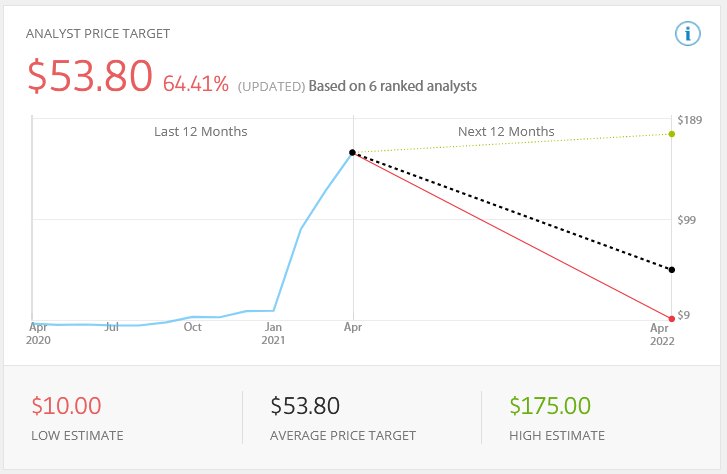

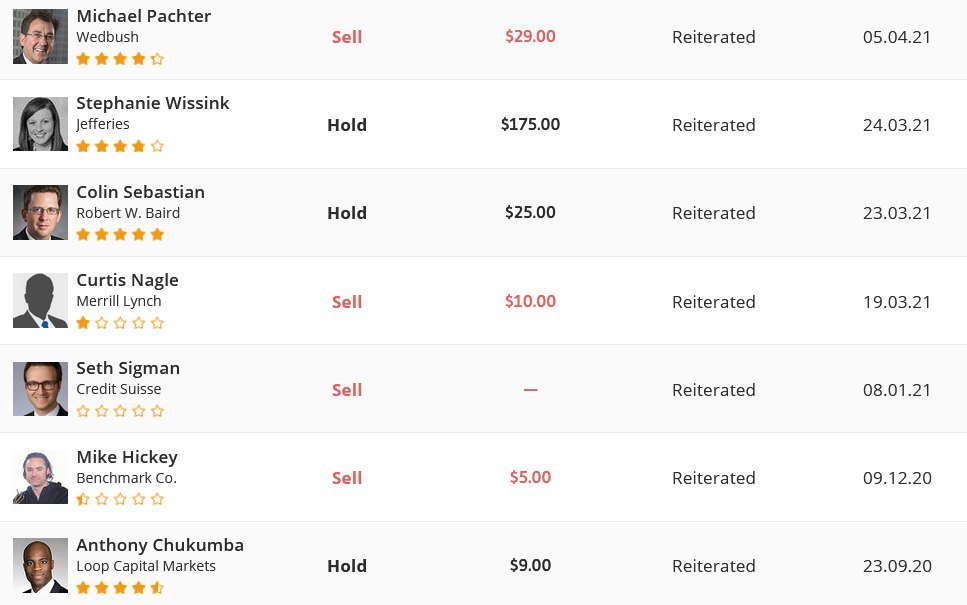

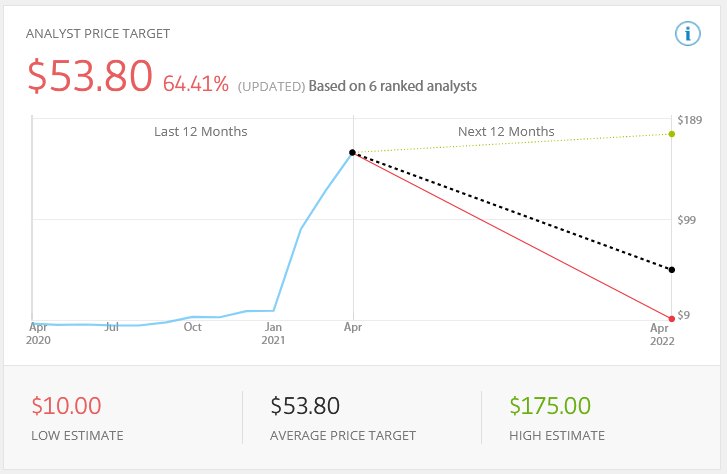

The target price consensus for analysts is $53.80 (based on TopRanks) anyway. That’s more than than 50% drop from the current price and a total -90% from the top:

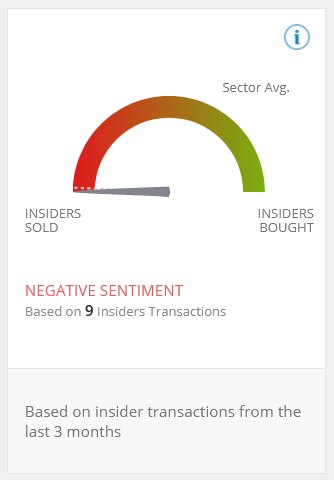

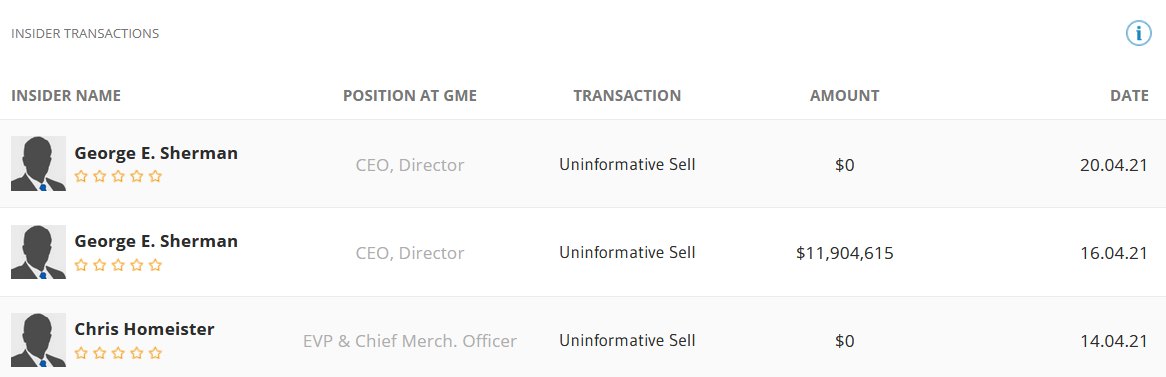

GME management sells off its stock as fast as they can before fire in the dumpster spreads. All insiders transactions in the last 9 months were sells:

This company is so bad, that even its CEO sells vested stocks. George Sherman sold $11 million in shares just a week ago, which contributes to overall loss.

Prepare for vicious ladder attacks first thing tomorrow morning. Malicious manipulating hedgies are coming for our throats. Hold the line. #AMC #GME

— Copelander06 (@copelander06) April 14, 2021

Beware vicious „ladder attacks”, sharp as a shark teeth!

And they've been actively stealing from retail investors through criminal naked shorting, short ladder attacks, wash sales, layering & spoofing, and of course, blatant lies and propaganda! $AMC $GME

— Lang Zyne (@LangZyne) March 25, 2021

But this is not the only make-believe term invented to explain why an overpriced stock is dipping. This user has it all in the single tweet – „naked shorting”, „wash sales”, „layering”, „spoofing” (and of course „blatant lies” and „propaganda”).

short ladder attacks jewish space laser hedgie pedo . ape gang

— m~o~s~e~s (@Moon_Diagrams) April 15, 2021

Mentally unstable people can provide their „due diligence” too.

The same wall-of-text fantasies are all over Reddit. GME going to $100k would take $65 trillion market cap. That’s more than the current stock value of all the stocks on Wall Street combined. Don’t these people have calculators at home?

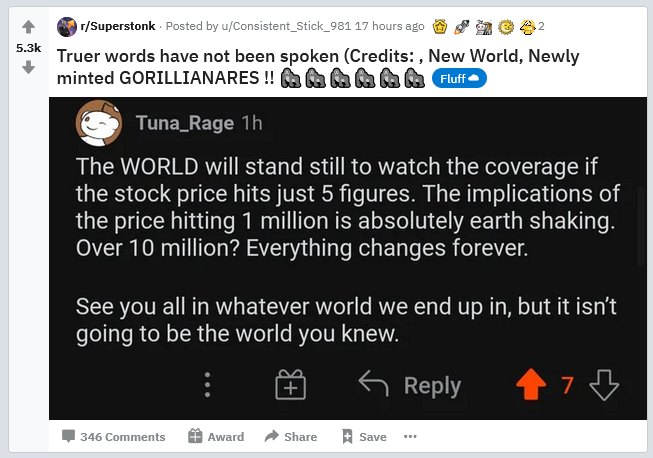

And some people are fantasizing about it going to 1 million – dozen times current US stock market capitalization, in posts, outrageously tagged „Education” and „Data” with unhinged „calculations” conjured completely out of thin air through a means of a lunatic wall of text. The only „market manipulation” comes from a disgraceful posts like this, that pose to be investment analysis.

Calculatorless Reddit users clapping and posting even more harebrained bets. Just FYI, GME priced at $10 million would take more than the entire money supply worldwide. For some perspective, current three world’s biggest market cap stocks are:

- Amazon: share price is $3641 at the time of writing,

- Google is $2754,

- Apple is $146 (they did too many splits).

Belief, that GameStop stock can go beyond $1 000 000 is ludicrous. But these conspiracy theorists will spin all sorts of pretense stories as they cling very badly to spurious thought, that the GameStop will finally turn their lives around:

These social media posts remind Multi-Level Marketing schemes and coming from the people being at the bottom of the ladder. There is also a Reddit for this, and in contrast, it’s one that I can recommend.

This is mindset permeates GME subreddits and posts like this gets thousands of Likes. It’s dangerous, unhealthy, and deranged. Once the stock collapses, a rude awakening awaits. There will be many victims of this failed investment, dragged down by shattered hopes pumped up by lunatic statements like this.

Scams like these were present since humanity was born. Ancient Roman sources mention investments in seafaring trade that ought to bring big profits from sailing as far as to Ind (now India) or Carthage, only to end as a scam. Even the Ponzi scheme is now more than 100 years old. Folk hero fighting evil corporations is nothing more than sour grapes.

Technical analysis

Internet GameStop fanboys sure love their technical analysis and their fancy charts and candles and colorful arrows. So here is one, that covers all the popular indicators and not cherry-picked „Japanese Evening Doji Star” candlestick patterns (there is one like that, really). But it doesn’t stand to ill-conceived hopes of changing life by buying a single GME stock.

In fact, technicals are so bad, that everything literally tells you, that you should get your money and GTFO now.

So where the GME goes in the next months?

Into the gutter. The stock market is cold and unrelenting and it doesn’t care about your feelings. You shouldn’t take financial advice from strangers on the Internet adn WallStreetBets with usernames like “idontknow100000”, “bvttfvcker”, “baconmaster9991” or “GloryholeSniper” (they’re real, just check them out).

Instead, deciding whether to buy or sell the stock, you should take a look at the real and not imagined data. The value of this stock is worth less than the analysts’ consensus, which is $53.80. Curtis Nagle from Merril Lynch believes it’s worth $10 – that’s more than 90% down from the current value.

The choice between taking advice from educated and successful men, or from “GloryHoleSniper” and “baconmaster9991” should be obvious for everyone.

In a few years, GameStop will be silently closing more and more stores, until forced to dissolution. The company closed 693 stores in 2020, reducing it to currently 5509. GameStop won’t cease to exist completely as a brand but will vanish as a company. Valve or Epic will buy it, taking over the clients and platform, turning it into a completely online store, and taking it from the stock market in no more than 2-3 years.

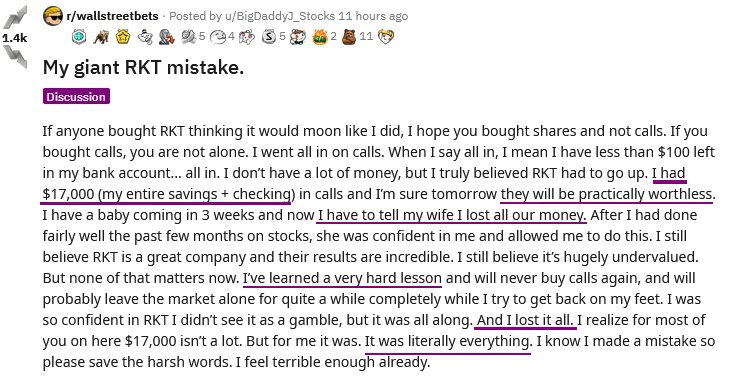

Unfortunately, it can end very badly. RKT (Rocket Companies, Inc.) was another meme stock pushed on Reddit. Users chose it, because it sounded amusing, like a rocket coming to the moon. Alas, for some users, it wasn’t that funny in the end:

A victim of Internet-induced investing frenzy.

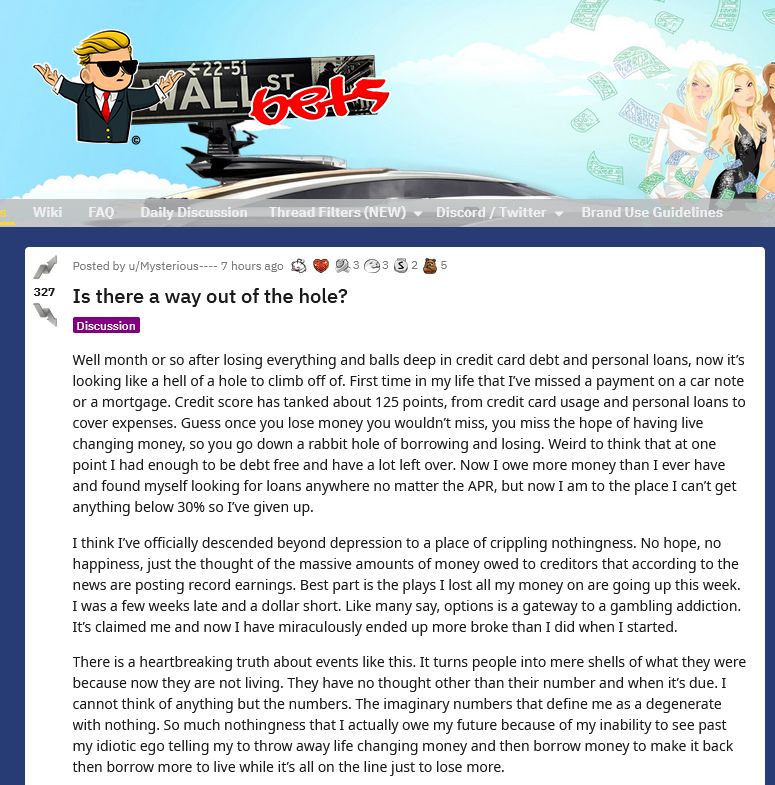

The fallout is already there and it will drag even more “investors”. Here’s another depressing Wall Street Bets post, posted just today:

Investing in penny stocks and leveraged instruments isn’t for everyone. That being said, there are plenty of fantastic opportunities right now, whether you’re looking at stocks, currencies or commodities.

Wheat prices went up +24% in the last 12 months. Just buy some fkng grain, instead of obsolete video game retailer stocks. Here’s what I wrote about a wheat a year ago.

The economy is soaring and you should invest in the stock market right now. But you won’t find gains in unprofitable brick and mortar game stores stock and other meme-tier instruments.

ape no read, stonk to moon

Sounds like your butt hurt about GME and AMC. Why do you even care if retail is losing money to hedge funds? Here’s a hint they aren’t losing money, the hedge funds are so f#$ked that they have to resort to writing this garbage of an article. Imagine thinking ladder attacks and naked shorts are just buzz words when you can easily look up the meaning on investepidia.

Well, if you say so it must be true. Because the possibility that 100s of people’s research is nothing but the writing of a bunch of lunatics (as you prescribed) is more likely than the possibility of them being onto something.

I mean, it’s not like anything like this ever happened before. Like 2008, when a few people called out in 05, 06 and 07 what will happen. There same people were called lunatics by the people who you are defending right now.

Well, I guess in the absence of historical evidence and the probability that 100s or 1000s of people are just to stupid to read and connect dots we’ll have to take your word for it.

Thank you for saving the American people from making a big mistake.

Nice try Ken.

It then.

WankEmperor more like.

I smell Ken

Judging from the comments, it looks like the cultists found this post, and they are not happy. “Here’s a hint, they aren’t losing money”? Oh really? What do you call being deep in the red because your stupid ass bought shares of a failing video game pawn shop for $300 each? Is that not losing money? Let me guess, “it’s not a loss if you don’t sell”. Yeah, totally not a loss. You can in fact pay your rent and buy food with the stonk money that you most definitely didn’t lose, just go up to the cashier and tell them that since you didn’t sell, you haven’t lost money, and they’ll just hand over the groceries.

Retards. I hate the GME chimps so much it’s unreal. Stupid, delusional cultists of the stock equivalent of QAnon. I have zero sympathy for them, they’ll never learn their lesson even if Gamestop goes bankrupt and gets delisted.

The WallStreetBets subreddit was a semi-satirical place where day trader-types would discuss their various tips, plays, wins and losses in an often humorous manner. They had a bunch of “insider” lingo and it was all frequently very tongue-in-cheek.

When the whole GME thing happened in late 2020-early 2021 WSB was all over it and a lot of regulars there made good money. When it all really broke there were thousands of posts, many of them facetiously urging others to “HODL” in order to push the price to 1,000, then 10,000, then 69,420 and so forth. They were inside jokes, just people screwing around having fun.

Then, driven there by the various news stories about GME, the “apes” arrived. These “apes” completely misinterpreted the lingo and the tongue-in-cheek nature of the “financial advice” they found there. They believed the silliness about “infinity squeezes” and etc. and bought themselves a lottery ticket. Everything “apes” know about the stock market consists of those stupid memes and inside jokes, they just don’t understand that none of it was real. Everyone who bought GME when it was $5 or $12 a share sold that crap as soon as it took off, they weren’t “really” buying more at $375.