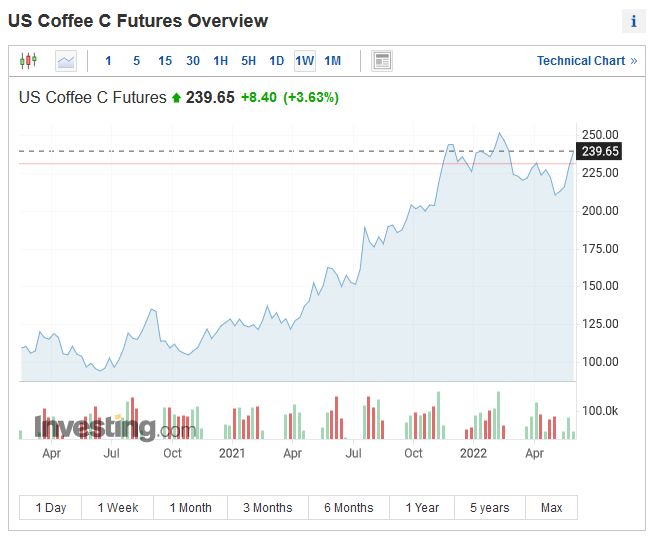

There are shortages now in every commodity market. The collapse of supply chains and an increase in fuel prices led to the dwindling cofee reserves. Coffee futures is now up 48.8% in 12 months. If you can’t start the day without potent espresso or maybe chilly macchiato, this won’t be good news for you. But this also offers the opportunity to get big returns from trading coffee futures.

ICE Cofee Futures gained 3.63% today, up 48.8% last 12 months.

Coffee – new timber?

Arabica bean reserves fell to 143 million pounds or 65,000 tonnes, according to ICE data, the world’s largest commodity exchange. Arabica is a high-grade cofee, compared to the cheaper grade Robusta. Starbucks generally serves coffee made from Arabica beans, while cheap coffee you can get in stores is usually Robusta, which has a stronger, bitter taste.

High prices are driven not only by the increase in fuel prices and labor costs, or problems with logistics but also by unfavorable weather in Brazil, which is the world’s biggest coffee producer. In addition, there is also a growing demand for coffee in countries like China.

Coffee prices should therefore remain at high levels for some time, propped up by these fundamental factors. However, traders should pay attention to the cyclical nature of this commodity, and the fact that it’s still far from all-time high. Growing trading volume also signals greater demand for coffee worldwide.

How to trade coffee?

Coffee futures are available from most brokers. Coffee contracts behave similarly to other soft commodities, i.e. they have high volatility, which allows for swing and day trading. If you decide to invest in coffee in the long term, don’t use leverage and take long-term factors into account such as the weather in South America, Asia and Africa, global demand, fuel costs and supply chains.

Alternatively, you can invest in coffee industry companies. The most popular choice is Starbucks (SBUX). While this global coffeehouse chain falls 32% year over year, this is still a global brand, that should recover from these losses in the coming months.

There are also at least two ETFs related to the coffee sector: iPath Pure Beta Coffee ETN and iPath Dow Jones-UBS Coffee ETN. Investing in these interesting instruments may awake your gains, but be aware of the high volatility.