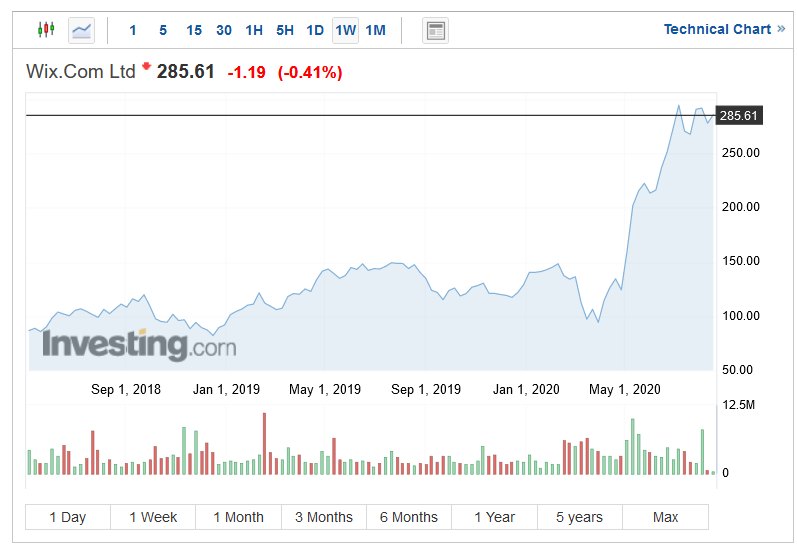

WIX is recently bombarding anyone who shows at least remote interest in webdesign with quite a bit annoying and cheesy Youtube ads. But this Israeli start-up experienced tremendous growth in last 2 years, offering +97.15% 1-year return and outperforming NASDAQ. It certainly looks like this stock has room for even bigger expansion. So should you pick up this stock as a long term investment? I’m highly bullish. Here is why I recommend Wix as a fantastic long term investment.

Why should you pick up WIX stock now?

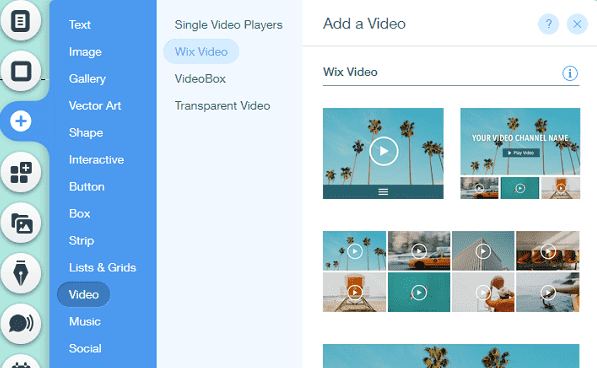

WIX made easy to use website creator intended for small businesses. It’s actually nothing revolutionary, as we’ve seen such WYSIWG software since the heyday of Dreamweaver or Microsoft Front Page more than 20 years ago. Comparing to WordPress, with its plethora of fantastic plugins and themes, WIX has just tiny amount of capabilities. And it’s cloud based, which might be off-putting for some, me included. I wouldn’t choose WIX over WP, never. But the main advantage is that it’s canned solution, with turnkey components for people that don’t want to bother with learning webdesign and even basics such as WordPress set up. And on top of that it has some very aggresive marketing, which is necessary to thrive in this highly competitive environment.

This is still a relatively new company, that joined NASDAQ in 2018. They offer cloud-based website creator with hosting, which is really simple to use. Wix quickly became popular because their creator is really simple to use and you don’t need to even have any basic HTML knowledge to make websites or even online stores. This allowed them to get 110 million users from around the world though only some of them are actually paying for this service, as you can get basic tools for free.

WIX revenue model

This leads to a great subscription-based revenue model, allowing the company to drive constant revenue, providing a useful product. It’s not a unicorn tech startup living off investors’ money, but they have great results for the previous quarter. The last result from April 2020 shows a 508% increase in new premium subscriptions, which are the main source of income, and a 123% increase in new payment merchants (online stores). Total revenue growth 24% year to year and free cash flow increased by 33% in the same period. The company is also expanding rapidly into untapped Asian markets, with a 19% increase in new customers. These numbers are exceptional and show that future growth looks really bright for Wix, and for us, it means that stock should continue its massive gains. Considering Wix is just 2 years on the American stock market (though founded in 2006 and based in Israel), that’s impressive.

It’s also still a relatively small-cap stock, which makes room for a future price increase. Total capitalization is only $13.69 bn, and if you compare it with loosely related stocks like Intuit ($78.9 bn) or ServiceNow ($79.4 bn), all available on eToro, you can see that potential growth looks promising.

The only drawback is that the company doesn’t pay dividends currently. But it’s quite common among startups that need to carefully count each dollar. Once the company matures, it will surely issue some payouts for holding the stock.

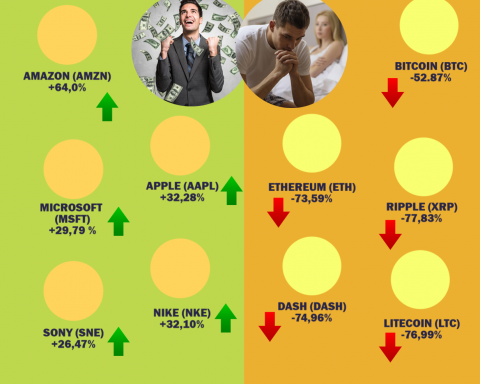

Fantastic growth in last years and especially since pandemic started. It seems like tech stocks are really resilient as capital is fleeing traditional markets.

WIX is currently my best performing instrument in the portfolio and despite such stellar growth, it still offers huge potential profits for investors. My suggestion is to pick it up now or wait for some NASDAQ retracement for an even better entry point. I advise not using any leverage for this stock as it can be volatile as befits small-cap start-up. Have a nice gains!