Here’s my monthly report on eToro activity in August, another good month, with +0,75% profits, which is my 10th consecutive month on green. What’s more, I’ ve managed to lower risk to 2/10 – my trades have never been so comfortably stable! Here are some August highlights from my eToro trades:

Natural Gas continue to flow

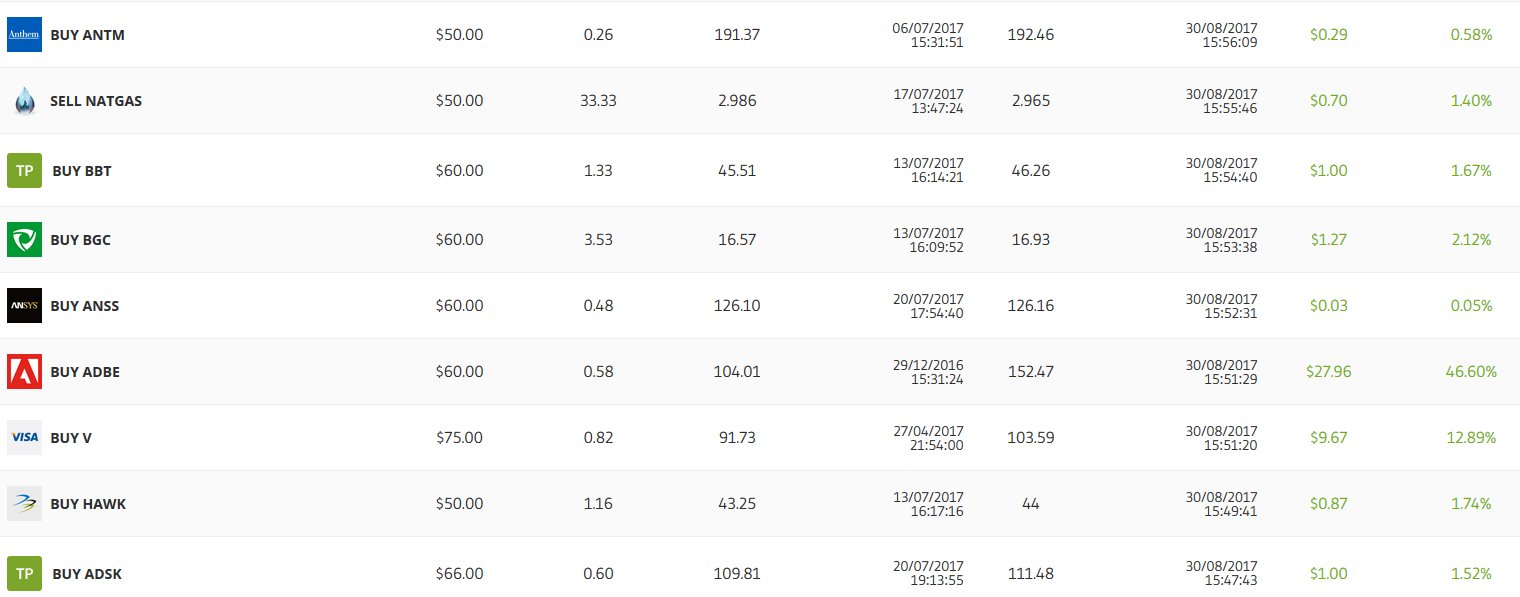

I always hold some SELL positions on NatGas, to earn from oversupply, general bearish trend and of course refunds that you can collect. I’ve closed all $NATGAS positions to collect profits at the end of the August and reopened it again a few days later in September. I’ve also traded some oil and and following this trend I plan to expand exposure to commodities in coming weeks (now its about 23%).

Banking on Snapchat weakness

Snapchat is a social app for teenagers with no real source of income. Since their IPO just 5 months ago stock price fell from $22.5 to $13 per share (almost 50%) and is falling constantly. Despite being popular, they make no money, so just before their quarterly report I’ve opened a x2 sell position to bank on expected bad results. It came out as expected at it gave me 12% profit on this position. It’s good to trade news and events, especially on currencies and stocks, because they are predictable! I will probably repeat this on next $SNAP QR.

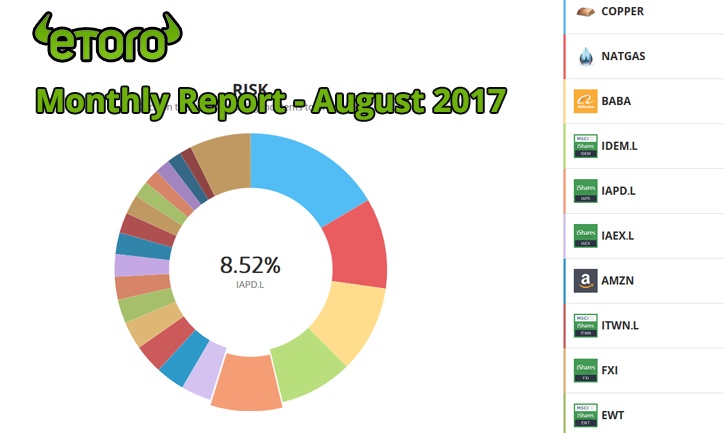

Diversification is key – always

As you can see below (click to enlarge), I am now trading every instrument type possible: ETFs, stocks, commodities, currencies, even some cryptos (though I have allergy to ETH). This makes my portfolio healthy, consistent and resistant to risk steming from volatility on a single market. It’s especially bad to go all cryptos as price of virtual currencies are correlated and all tend to go up or down at the same time.

What’s next?

September will be a month of bigger allocation of ETFs and commodities – retaining low risk. I expect + 1,5% this month. General trend is very bullish, so now is a very good time to invest.

Monthly results:

Profits: +0,75%

Risk score: 2/10

Max risk: 3/10