Here’s monthly report on eToro profits taken in October. That’s another great month, with +4,37% in profits (38,75% 1-yr return), 11th out of 12th profitable month this year, and on top of that, achieved with a very low risk of 3/10. I am satisfied, because not only I’ve managed to achieve some very good results, beating NASDAQ and Dow30, but I also plotted and executed some interesting strategies. Here are October highlights from my eToro trades:

Researching and buying 3QR stocks for fun and profits

Because third quarter earnings season started just 2 weeks ago, I thought, why not try betting on QRs by research and picking stocks that will get the best result, buy it the day before the report with x5 leverage and sell it afterwards, when the good news drive the price up. It proved to be an excellent strategy. I wasn’ sure if this work out in practice, so I’ve tracked performance in and as it happened, it worked perfectly. Out of 14 quarterly reports I correctly guessed 13 companies that exceed Wall Street expectations and these leveraged one-day trades got me as much +25% profits on single position.

Stock tickers that I researched to profit from quarterly reports. These got me some nice $$!

And that’s not all – earning season is still going on, so I will repeat this in November with even more stocks. I will share this strategy with you later and write a tutorial how I achieved this, so stay tuned and be sure to check my blog in next few days if you are interested!

Number of QRs for 1-7 November. As you can see, a lot is going on with as much as 600 reports released daily, and each being a chance to earn on its outcome! These numbers come from earningswhispers.com – a very handy site that I used to pick and research these companies.

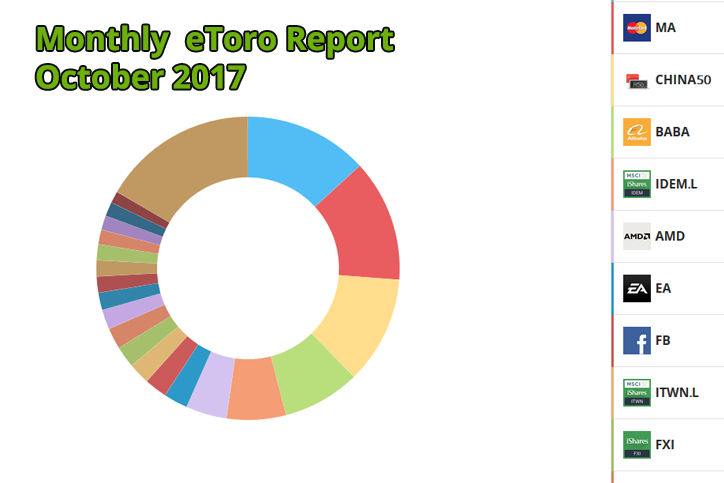

Allocation structure in October

I believe that diversified porttfolio is the best way to maintain long term profits and minimize risk as much as possible and I am trading every instrument type possible: stocks, ETFs and indices – about 90% allocation, but also commodities, currencies, and even shorting some cryptos. This makes my portfolio healthy, and more resistant to risk from investing in a single instrument, like Shopify and AMD that had some very bad times in October. This helped me achieve big gains last month. Remember guys: reduce exposure by buying various assets!

Don’t put all eggs in one basket!

What’s next?

As mentioned previously, I’ll try banking on QR reports + I believe that next months should be very good for Asian economy, so I will be trading China A50 index and ETFs with exposure to Asian stocks.

Monthly results:

Profits: +4,37%

12 months return: +38,75%

Risk score: 3/10

Max risk: 3/10

Disclaimer: All trading involves risk. Only risk capital you’re prepared to lose. Past performance is not an indication of future results. This content is for educational purposes only and is not investment advice.