Latest FINRA test reveals terrible results – it seems like nowadays people got much dumber at handling money and can’t answer properly simple questions about interest rates or mortgage. FINRA diplomatically explains this sharp decline by low interest-rate and low-inflation environment, that we currently live in. “These concepts are not relevant to everyday life to those 35 and under where most of the declines are happening,” FINRA representative explains, but I wouldn’t say it’s true.

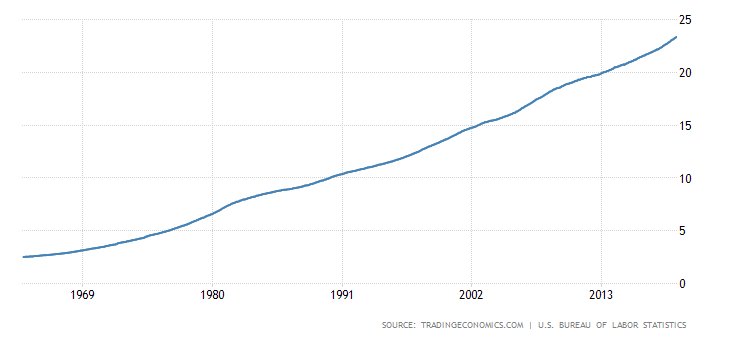

The reality is that young people simply got more careless and putting it bluntly – dumber when it comes to money. They don’t care that much because they don’t need to. The opportunity to get money is unprecendented and there weren’t better times to live in – at least when it comes to economy. The unemployment is (almost) all-time low, the wages are higher than ever, even when comparing Purchase Parity Index.

Here’s what Millenials are failing

The share of 18- to 34-year-olds who answered at least four of the five questions correctly fell by nearly half in the last nine years, going from 30% in 2009 to 17% in 2018. Millenials especially have problems with bond rates, but even simple questions about interest rate prove to be a problem for almost a third of them. And only 55% understands the concept of inflation (question number 2).

What’s more, 7 in 10 gave themselves high marks, even though only a third answered at least four of the five questions.This lack of humility doesn’t bode well for the future, and we can surely expect further decline in financial knowledge for future generations.

Why Millenials got everything better?

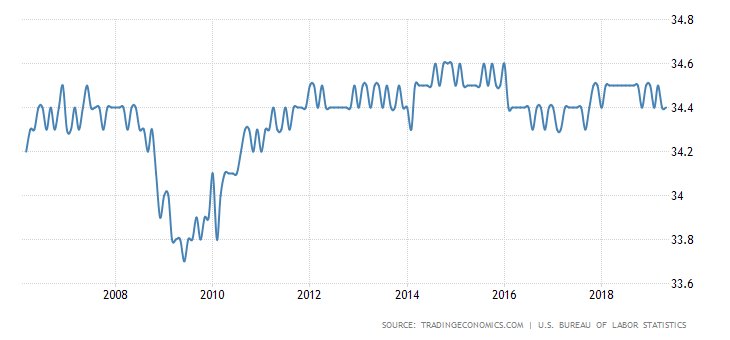

US unemployment rate – now at 49-years low. For comparison, during mid-eighties it was about 10-12% and it wasn’t that easy to find job. Now, if you can’t find a job, you simply don’t want to work.

Even the idea that Millenials work ‘harder’, as they supposedly spend more time in work, is fake, as proven by US Bureau of Labour. Average number of working hours remain pretty much the same throught last 10 years.

And there is staggering number of vacancies that amounts 8 million. Employers can’t find employees anymore, even most prestigious companies like Microsoft and Google no longer require a college degree to get the job as they couldn’t find any job candidates.

You really need to have no skills to earn $12 an hour in US. Maybe you should start learning some trade or get education, instead of whining on Twitter?

Not to mention, the average hourly wage is now $23.30 – a record high, even adjusting to inflation.

This is how Millenials envision current state of economy. Silly and sad at the same time.

Feeling smarter than typical millenial? Take the test!

Here is the original test (correct answers below) that so many people fails. See if you’re better than typical Millenial and take it now.

1. Suppose you had $100 in a savings account and the interest rate was 2% per year. After 5 years, how much do you think you would have in the account if you left the money to grow?

a) More than $102

b) Exactly $102

c) Less than $102

2. Imagine that the interest rate on your savings account was 1% per year and inflation was 2% per year. After 1 year, how much would you be able to buy with the money in this account?

a) More than today

b) Exactly the same

c) Less than today

3. A 15-year mortgage typically requires higher monthly payments than a 30-year mortgage, but the total interest paid over the life of the loan will be less.

a) True

b) False

4. Buying a single company’s stock usually provides a safer return than a stock mutual fund.

a) True

b) False

5. If interest rates rise, what will typically happen to bond prices?

a) They will rise

b) They will fall

c) They will stay the same

d) There is no relationship

(Correct answers below)

1. a

2. c

3. a

4. b

5. b