Officialy China is a Communist country, sticking to Real Socialism economic policies of central steering, five-year plans (yes, they still have it), inflexible yuan exchange rate and mercantilism that shouldn’t work in real world. So why have they managed to buil world’s second biggest economy? Because Chinese says one thing and do another, which is typical for Far East Asian culture (they definitely stick to Sun Tzu’s “Art of War” in business) and instead of Communism their economy is more like State-Controlled Hyper-Capitalism. How can even stock market exist in communist country? It can, and not only it works smoother than in Argentina, Russia or Greece, not to mention African countries, but it offers tremendous possibilities for investors. Bored with NASDAQ and wanna profit from PRC market? Read on.

What consists of China A50 index?

There is no single stock market in China, but instead there are two big markets: Shenzen and Shanghai (plus Hongkong that uses its own index to track performance). It tracks 50 companies from aforementioned exchanges, and what’s actually nice, these stocks come from class A Share like Alibaba, better known in the west as an owner of Aliexpress. Chinese mercantilism, natural for communist states is still going strong, so they protect their market in a form of prohibition of sale of these assets to foreigners. So this is basically your chance to invest indirectly in Chinese giants like state controlled banks, construction companies or oil refineries.

Current Top 5 constituents consists of world’s biggest insurance company (Ping An), huge banks, giant electrical appliance manufacturer with 100 000 employees (produces appliances for Xiaomi) and world’s biggest booze distiller.

You can see full list and performance on dedicated FTSE page.

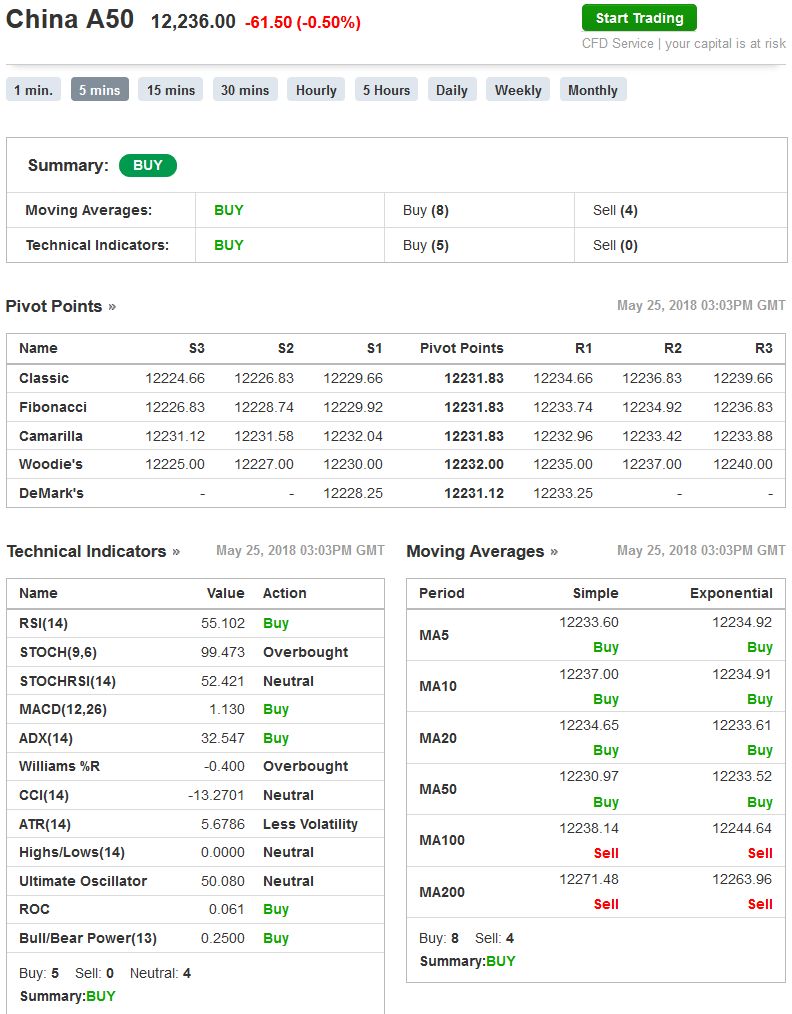

So should I buy it or sell it?

Don’t fight the tape. Don’t short it. With economy that grows at 6% a year it’s impossible that Shanghai or Shenzhen stock market will topple, especially that there are many safety-valves now introduced by Chinese regulator. The only correct position is long.

How to time investment on $China50 on eToro?

Timing your trade is crucial in case of this position, because it’s just one of two CFD’s (the other one is $copper) available on eToro that has expiration date. Start by going into market hours page, pick Indices and see current expirations:

There are also bank holidays listed for all instruments. As you can see, contract expires once a month. This mean that you should open new positions preferably at least 2-3 weeks before expiration, to get enough profitable days in one contract cycle.

So proper timing in opening a trade should meet all this conditions:

- Proper entry point – preferably after it corrects a bit after the increase. See if there was 1-3 days of correction (drop in price) that would indicate continuation of a trend. You can use your favorite technical indicators on 5-15 mins chart for this or just look at the chart and see if it looks OK.

You can see technical indicators generated in real time here: https://www.investing.com/indices/china-a50-technical

An example of proper entry points above.

- At least 2-3 weeks before next expiration – so your trade would have momentum to grow before expiration.

- In case of China, no news is best news. Chinese market seems to be very susceptible to news and rumors, and despite being second world’s biggest stock market in terms of market cap after US, it reacts really violently even to really unimportant events – and it actually fast returns to mean. My guess is it has to do with East Asians collective mentality. So before trading, check if Trump hasn’t tweeted any (usually stupid) tweet or if there is no ongoing story about trade war, North Korea, sabre rattling with Worst China, etc.

The concept of global warming was created by and for the Chinese in order to make U.S. manufacturing non-competitive.

— Donald J. Trump (@realDonaldTrump) 6 listopada 2012

Can you be any dumber than that? I bet you can’t.

If these three conditions are met, open your trade and hold it till expiration date. After that, reopen it again, using this three factors, rinse and repeat. If executed properly, you should be able to outperform $China A50 (currently it’s at 14.9% a year). And you can even try buying it with leverage.

What leverage to use?

The nice thing about this index on eToro is that there is no additional fees on leveraged $China50 trades, unlike stocks. This means that you can compensate monthly expiration fee by going into x2 or x5. Remember that safe investment is better than risky one, so my suggestion is to go at most x2 (that’s my current rate of trading this CFD) because sudden drop and you’ll spectacularly delete your capital by badly placed high-risk trade.Don’t be greedy and remember the Chinese proverb:

When money is stolen you can only beat the dog.

So please, don’t beat the dog. It’s not appropriate in our cultural circle. Have a nice profits!