Well known ponzi scheme and pseudo-cryptocurrency Bitconnect (should we call it crypto cryptocurrency?) have performed an exit scam and run away with all investors money. Bitconnect promised 1% profits daily (yes, each day) and it has been internet pyramid scheme veiled in a fashionable cryptocurrency investment that gained a lot of followers worldwide. A day of losses for all virtual coins linked to planned closures of Korean and Chinese cryptocurrency exchanges led to 95% decrease in price of Bitconnect (BCC) that unfortunately have been in 20 biggest cryptocurrencies, with market capitalization of $2.5 bln. This means that immense amount of money just evaporated from market and individual investors reporting that they lost “all their money”.

Bitconnect website stated that they will:

“closing the Bitconnect lending and exchange platform.”

The website has since gone down, and their social media have gone silent. Company also deleted all their official Youtube videos. Even their Wikipedia page is being purged now and is inaccessible as an attempt to cover any trace of criminal activity:

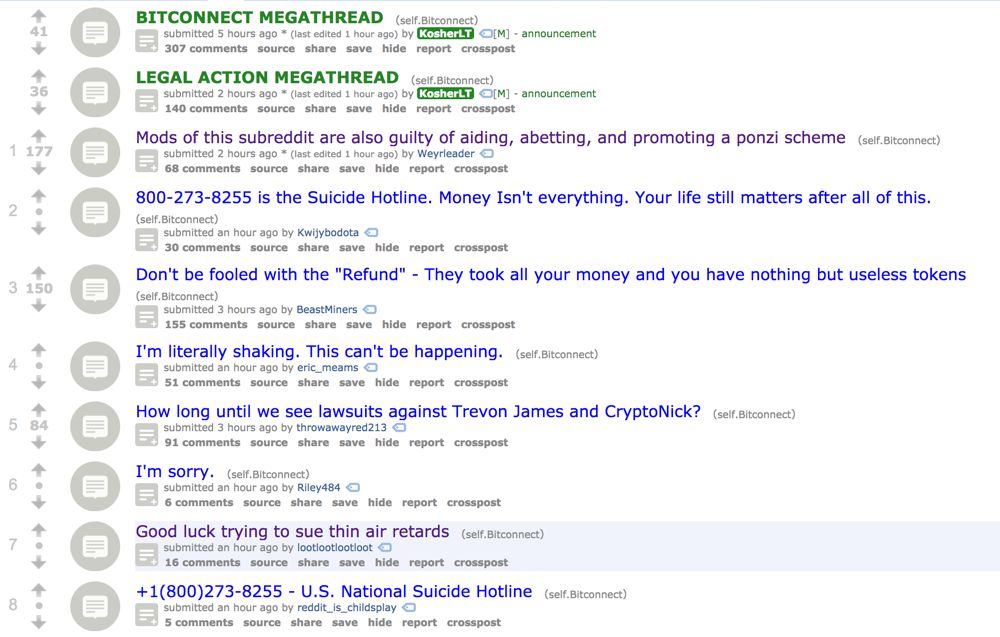

And their Reddit group was set to private, and no one can’t access it. Fortunately, some user have archived it before it went off. It looks really unpleasant. Investors are still confused, can’t be believe they lost all their money and judging from social media comments, they still have hope, that it would be possible to somehow recover their loss. But it won’t be, because “Beeeeconnect!” already ran with their money.

Archived /r/bitconnect subreddit, before it went off (click to enlarge).

So can the funds be recovered?

It’s real. This is their infamous conference with CEO making his “Beeeeconnect” performance, mocked online.

No. This is a classic exit scam, executed when pyramid scheme falls. Bitconnect is registered as a network of companies in Vietnam (main company) and on tax havens and this money is untracable, because it might be easily already converted into Monero, another cryptocurrency favored by criminals, that lets launder money very easily. Just like in case of infamous case of Mt. Gox, police won’t be able to recover money. Don’t count on lawsuits too, because no one even is sure who is actual owner of Bitconnect assets, because real entities that are behind this operation aren’t disclosed anywhere. But Mt. Gox went insolvent with $450 mln worth of Bitcoins – and Bitconnect scam is more than 5 times bigger than Mt. Gox. This will surely entail insolvencies of other smaller cryptocurrencies and will be one of the many nails to the Bitcoin coffin, tearing apart entire cryptocurrency market.

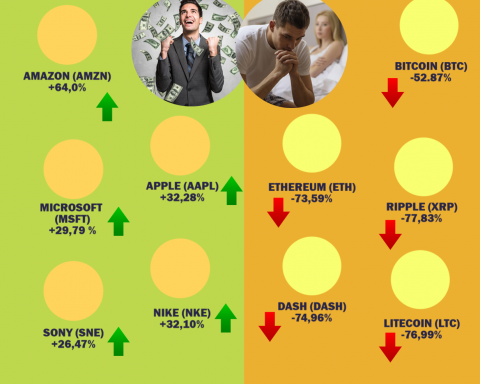

Assuming a $2 billion scam will “tear apart” a $500 billion market of an entirely new type of asset is ridiculous. Bitconnect very much stood alone as just one more coin in the market, and having $2 billion melt away in this market is not exactly unheard of. Usually it’s not through a scam, but the entire market itself dropped something like $200 billion in the past week. Big dips in January is nothing unheard of either. Bitconnect is a tragedy for all the weak minded who “invested” in it. For the rest of the crypto market, the large overall dip right now is what’s people are preoccupied with. Even though most agree that it’s just profit taking and some FUD from the East that’s currently slowing things down.

Also worth noting that at about $500 billion, the market is down… to where it was just three weeks or so ago. This is a correction after a massive bull run to almost $800 billion, nothing more, and all the old-world investors who’d lose their minds if stock corrected 30% just don’t understand that a 30% drop in cryptocurrency is something crypto traders refer to as “a Tuesday”.

If you believe that $2 billion melt away is nothing and that other cryptocurrencies are so much different from Bitconnect, you are deluded.

Correct, about 90% of cryptos are absolute shitcoins. Do you know what that leaves? Over one hundred fantastic projects with real teams and products. Anyone who takes the time to do some in dept research before they invest will do very well in this space.

The folks that bought bitconnect based on memes and shitty youtubers get what they asked for. Garbage in, garbage out.

*depth….. fucking mobile

You seriously think crypto is dead? You are delusional. Most people that are into crypto already saw what Bitconnect was. People have been saying it’s a scam for a long time.

Other cryptocurrencies are VERY different.

I’ve read some of your stuff before. Why are you so strongly against cryptocurrency? A rational person would recognize the value this new form of technology can bring. The technology and it’s implications aren’t scams or crapshoots; the cons who leverage it are.

There’s no “technology” behind cryptocurrencies, only greed and Lamborghini dreams. You can’t even pay with Bitcoin anymore. There’s no implications and no real world uses for fake internet coins, but a fad that will slowly burn out, that will make few scammers very rich, at the expense of naive “investors”. Just like in the case of Bitconnect.

OMFG! Are you kidding?? No technology behind crypto?? My god you’re so ignorant it borders on the terrifying!!

I’ll bookmark your comment and return in a couple of years for much LOLs!

I guess that’s all that can be said about fake internet coins 🙂

Tch. Real ignorant this one.

No technology behind it? ever heard of “Blockchain Technology?” Even the name gives it out, and, like it or not, it’s revolutional and is changing the way we store and use our money, without any third party in the middle.

And Fake internet coins? Just because it’s not physical does not mean it’s not real. It works the same way as USD/FIAT does, it has value because people think it does. Difference is, one is printed, and the other is not. Of course that is not the only difference, but just so your brain can process it.

This blockchain is so revolutionary, that you can’t even pay with Bitcoin anymore, unless you want to wait for several days or pay a fee of $40 or even more. Truly masterpiece of modern payment technology!

You say it like Bitcoin’s the only one using this technology.

There are other cryptocurrencies besides Bitcoin, y’know. And they work pretty damn well, almost all using the same technology.

I agree that, right now, Bitcoin is slow and inconvenient, and it is overhyped. We are seeing scaling solutions developments very slowly for the quick growth it has seen recently. But this does NOT make the technology bad because one or two coins are doing it wrong. Blockchain Technology is here to stay.

This is just blatant ignorance on the subject. Bitcoin takes around 10 minutes to process a transaction, regardless of position on earth. You can compare that to a bank that takes days. The network fees you are talking about are $10-15 dollars not $40.

Bitcoin is version one of a new technology; it’s expected for it to have significant bottlenecks over time. At this point bitcoin is primarily a store of value rather than a practical means of buying stuff. Although the technology is capable of being further refined and probably will be integrated soon.

All of the issues you suggest are already solved with other cryptocurrencies such as Litecoin which has tiny transaction fees (under $1) and processes transactions in under 2.5 minutes.

By the time v3 of blockchain rolls out, you can expect transactions in under a minute and fractions of a cent in fees. The underlying technology will also be “smart” like Ethereum is today; in other words, capable of running programs.

Data on blockchain is meant to be immutable, irrefutable and unhackable thanks to decentralization and cryptography compared to a centralized server that holds everything in one or multiple specific places.

With your dogmatic approach to all of this suggests you probably just hate cryptocurrencies because they are disruptive to the stock market.

…dude are you trolling or what? I’m hoping that the level of ignorance you’re spewing in these comments is just a joke.

Remember: money isn’t everything and you can always call Suicide Hotline!

Crypto currency isn’t money, it’s equity. That’s why it will never succeed as an actual currency because it doesn’t hold a stable value. If I own a coffee shop, and I accept bitcoins, I would not know how much I am actually earning when the payments I get have such volatility in its value. It’s like paying for a donut worth 1 dollar and you pay me with 1 bitcoin, and let’s say today, 1 bitcoin is equivalent to 1 dollar, and tomorrow it’s .90 cents. How will I be able to actually run a stable business.? That .90 cents can be 100,000 today and 90,000 tomorrow. That’s too much volatility for a business

Your blog speaks for itself, you’re a stock investor, not a crypto investor. Your trying to get people to put money in a rigged stock market rather than the only true free market left on this planet, which is cryptos. Now wall street is trying to tear down bitcoin with the futures market, it’s disgusting.

How much did you lost in this scam?

Lol this scam was obvious and everyone was warned repeatedly by the crypto community. If people lost money I really can’t feel bad for them. If anything you pitty them in the way you pitty the flat-earth crowd. Nothing we could’ve said would’ve helped them.

This is what happens when you buy shitcoins and scams. Buy real projects and hodl.

And we tried to reason with them and show them that the math didn’t jive and they still defended the scheme tooth and nail even outright attacked us verbally. When the math shows that bitconnect was going to create the worlds first trillionaires and they still didn’t see how ridiculous that was, I knew there was no reaching them. I don’t feel bad for them at all because I tried to wake them up. My conscious is clear.

Just lol at people who invest more than they can afford to lose in hyper-volatile markets with close to none supervision. I can’t believe this keeps happening (especially in the US) even after more than a century of modern financial markets. I really can’t blame the mom and pops investors in 1929; hell, anyone who is suicidal because of the BitConnect scam is a fool and a fool is quickly and surely parted from his money.

“tearing apart entire cryptocurrency market.” You must be new here. Bitconnect is a scam. Usi-tech is a scam. None of them are even remotely comparable to BTC, ETH, LTC, ect.. Bitconnect was a ponzi lending system using BCC as a utility token for the platform. Hardly a crypto in the first place.

Everyone knew Bitconnect is a Scam. Literally everyone. The people who fell for it didn’t do any sort of research. Like not even the most tiny minimum. We all knew it will fall apart. No surprise there.

Scumbags like OneCoin and Bitconnect appear in every market, even traditional ones. Yes, those youtubers should go to jail, and yes, the profiteurs as well, but for fucks sake, people, this is not DisneyLand. If anyone promises you guaranteed returns and you don’t even get a tiny bit suspicious…. I don’t know what to say. It’s life lessons that those have to learn.

I really feel that everyone involved with Bitconnect, even the YouTubers were all scammed. Think about it, if you were one of the YouTubers who took a chance with Bitconnect and made money, you would scream to the hilltops that it works. I see everybody bashing the ones who made money, when you can see they were just as clueless as their downline. Now people are threating them, when you should be upset with the clowns that started Bitconnect. if you did some research you would have found out that one of the guys involved in Bitconnect was asssociated with OneCoin which was also found out to be a ponzi scheme. DO YOUR RESEARCH, investigate the team, look for a company address, phone number, and names, faces, and background. I looked into FiCoin because a friend told me about it, but the team won’t disclose their full names or faces, and listened to a webinar where they won’t show their faces and had accents i don’t trust. conclusion: I’M NOT TOUCHING FiCoin.

do a good documentation on this video + article and post iton steemit and link it to everyone this should make you a lot of money

regards

You have no clue sir, bitcoin is here to stay

Investing in a ponzi scheme isn’t necessarily a bad investment. It depends on the timing. You have to get in near the start of the lending service, and get out before most of their investors are able to pull out their principle. You invest a lot for the shortest term, triple your money in 60 day’s, and then move it to another “new born” ponzi. Rinse and repeat until your greed is sated.

I bet many people that lost their entire savings in Ponzi thought the same.

wow this article sucks!

More than three years later and Bitcoin and crypto still haven’t taken over like the nit wits in these comments said it would. And it never will. Lol. Instead, new crypto scams have popped up like NFTs. Only one thing is certain: The crypto bros will never run out of suckers to scam.